2025 High-GHz Terahertz Imaging Systems Market Report: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities Through 2030

- Executive Summary & Market Overview

- Key Technology Trends in High-GHz Terahertz Imaging

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

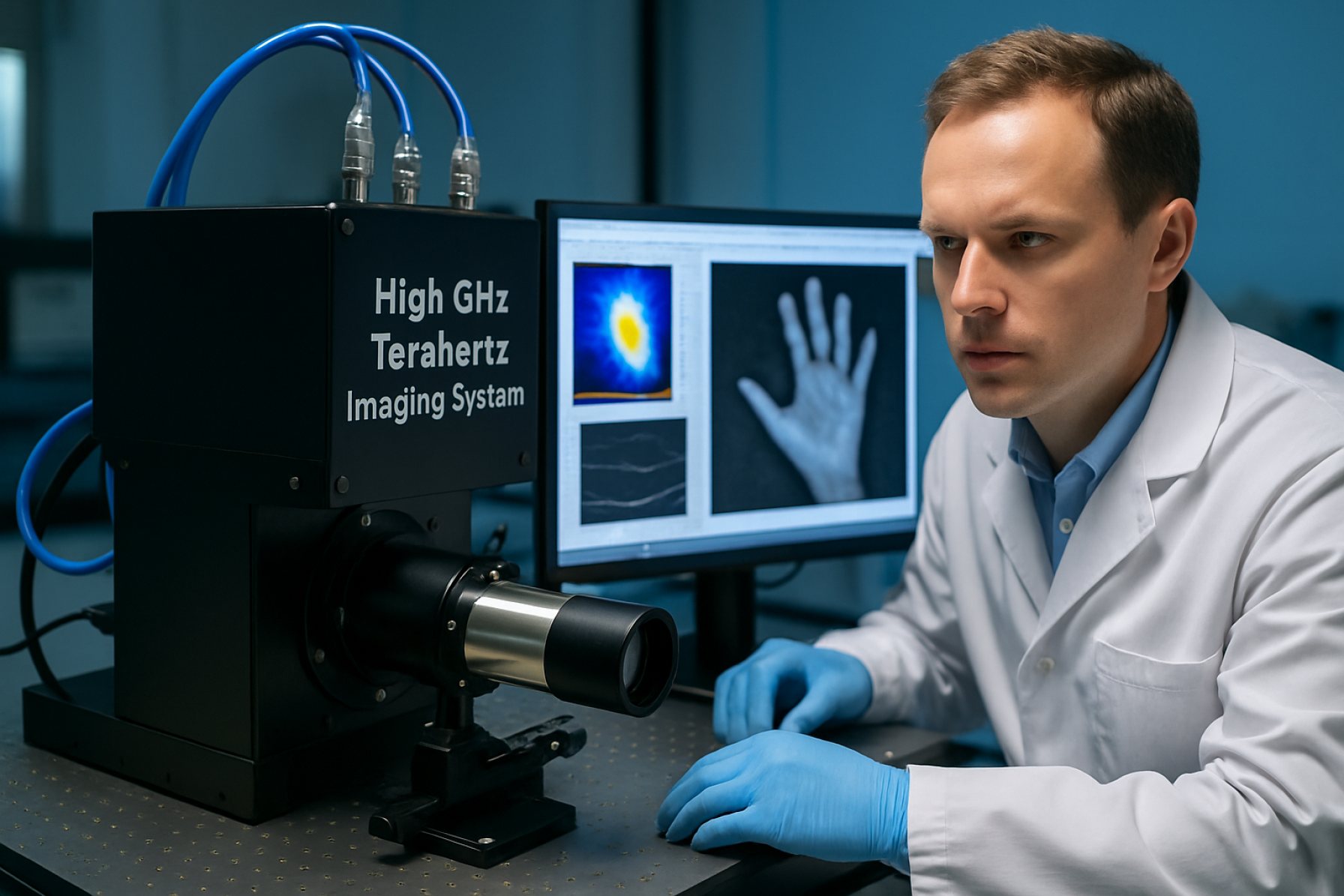

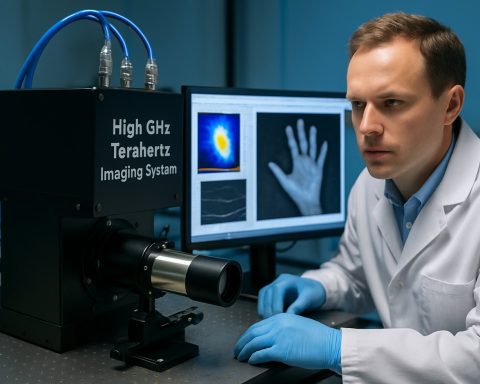

High-GHz Terahertz (THz) Imaging Systems represent a rapidly advancing segment within the broader electromagnetic imaging market, leveraging frequencies typically between 0.1 and 10 THz. These systems are distinguished by their ability to penetrate a variety of non-conductive materials, enabling non-destructive testing, security screening, and advanced medical diagnostics. As of 2025, the global market for high-GHz THz imaging systems is experiencing robust growth, driven by technological advancements, expanding application areas, and increasing investments from both public and private sectors.

According to MarketsandMarkets, the global THz imaging market is projected to reach USD 1.2 billion by 2025, growing at a CAGR of over 23% from 2020. This growth is underpinned by the rising adoption of THz imaging in security and surveillance, particularly at airports and border checkpoints, where the technology’s ability to detect concealed objects without ionizing radiation offers a significant advantage over traditional X-ray systems. Additionally, the pharmaceutical and biomedical sectors are increasingly utilizing high-GHz THz imaging for quality control, molecular analysis, and early-stage cancer detection, further expanding the market’s scope.

- Technological Innovation: Recent breakthroughs in compact, high-power THz sources and sensitive detectors have significantly improved image resolution and acquisition speed. Companies such as TeraSense Group and TOPTICA Photonics are at the forefront, offering turnkey systems that are more accessible for industrial and research applications.

- Regional Dynamics: North America and Europe currently lead the market, driven by strong R&D ecosystems and government funding. However, Asia-Pacific is expected to witness the fastest growth, with countries like Japan, China, and South Korea investing heavily in THz research and commercialization (Grand View Research).

- Challenges: Despite promising growth, the market faces challenges such as high system costs, limited penetration depth in certain materials, and regulatory hurdles for medical applications.

In summary, the high-GHz THz imaging systems market in 2025 is characterized by rapid innovation, expanding end-use applications, and a competitive landscape shaped by both established players and emerging startups. The sector’s trajectory is set to accelerate as technological barriers are addressed and new use cases emerge across industries.

Key Technology Trends in High-GHz Terahertz Imaging

High-GHz terahertz (THz) imaging systems, operating in the frequency range of approximately 100 GHz to several THz, are at the forefront of next-generation imaging technologies. In 2025, several key technology trends are shaping the evolution and adoption of these systems across industries such as security, healthcare, and materials science.

- Advancements in Source and Detector Technologies: The development of compact, high-power THz sources—such as quantum cascade lasers and photomixers—has significantly improved system performance. On the detector side, innovations in room-temperature, high-sensitivity sensors, including Schottky diode and bolometer arrays, are enabling faster and more accurate imaging. These advancements are reducing system size and cost, making high-GHz THz imaging more accessible for commercial applications (THz Network).

- Integration with Artificial Intelligence (AI): AI-driven image reconstruction and analysis are enhancing the resolution and interpretability of THz images. Machine learning algorithms are being deployed to automate defect detection, material characterization, and anomaly identification, particularly in non-destructive testing and medical diagnostics (IDTechEx).

- Miniaturization and Portability: The trend toward miniaturized, portable THz imaging systems is accelerating, driven by advances in semiconductor fabrication and photonic integration. Handheld and mobile THz scanners are emerging for field use in security screening and industrial inspection, expanding the market beyond traditional laboratory settings (MarketsandMarkets).

- Broadband and Multi-Modal Imaging: High-GHz THz systems are increasingly capable of broadband operation, allowing simultaneous acquisition of spectral and spatial information. Multi-modal imaging—combining THz with X-ray, infrared, or ultrasound—provides complementary data, improving diagnostic accuracy in medical and material analysis (Optica).

- Standardization and Commercialization: Efforts to standardize system interfaces, calibration protocols, and data formats are underway, facilitating interoperability and accelerating commercialization. Industry consortia and regulatory bodies are playing a key role in defining benchmarks for performance and safety (IEEE).

These trends collectively indicate a maturing market for high-GHz terahertz imaging systems, with 2025 poised to see broader adoption and new application domains driven by technological innovation and ecosystem development.

Competitive Landscape and Leading Players

The competitive landscape for high-GHz terahertz (THz) imaging systems in 2025 is characterized by a blend of established photonics companies, specialized startups, and research-driven organizations, all vying for leadership in a rapidly evolving market. The sector is marked by intense innovation, with players focusing on enhancing imaging resolution, system integration, and real-time data processing capabilities to address applications in security screening, non-destructive testing, and biomedical imaging.

Key industry leaders include Terasense Group Inc., which has maintained a strong market presence through its scalable, modular THz imaging arrays and turnkey solutions. TOPTICA Photonics AG is another prominent player, leveraging its expertise in high-frequency photonics to deliver advanced THz sources and detectors tailored for both industrial and academic research. THz Systems and BAE Systems plc have also expanded their portfolios, targeting security and defense applications with robust, high-throughput imaging platforms.

Startups such as The Wave Imaging and Menlo Systems GmbH are driving competition by introducing compact, cost-effective THz imaging modules that integrate seamlessly with existing inspection and diagnostic workflows. These companies are often at the forefront of miniaturization and system integration, making THz imaging more accessible for medical diagnostics and industrial quality control.

Strategic partnerships and collaborations are a defining feature of the competitive landscape. For instance, Advantest Corporation has partnered with research institutions to accelerate the development of high-speed, high-sensitivity THz imaging systems for semiconductor inspection. Meanwhile, Canon Inc. and Sony Corporation are investing in R&D to leverage their sensor technologies for next-generation THz imaging platforms.

Geographically, North America and Europe remain the primary hubs for innovation and commercialization, supported by strong government funding and a robust ecosystem of research universities and technology incubators. However, Asian players, particularly from Japan and South Korea, are rapidly scaling up their capabilities, intensifying global competition.

Overall, the high-GHz terahertz imaging systems market in 2025 is defined by rapid technological advancements, strategic alliances, and a dynamic mix of established and emerging players, all striving to capture share in a market projected for significant growth in the coming years.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for high-GHz terahertz imaging systems is poised for robust expansion between 2025 and 2030, driven by accelerating adoption in security screening, non-destructive testing, and medical diagnostics. According to projections from MarketsandMarkets, the terahertz imaging market is expected to achieve a compound annual growth rate (CAGR) of approximately 23% during this period, with high-GHz systems—those operating above 0.3 THz—outpacing the broader segment due to their superior resolution and sensitivity.

Revenue forecasts indicate that the global market for high-GHz terahertz imaging systems will surpass $1.2 billion by 2030, up from an estimated $350 million in 2025. This surge is attributed to increased investments in advanced imaging technologies by governments and private enterprises, particularly in North America, Europe, and East Asia. The medical imaging sector is projected to be a key revenue driver, with high-GHz systems enabling earlier and more accurate detection of cancers and other pathologies, as highlighted by IDTechEx.

In terms of volume, unit shipments of high-GHz terahertz imaging systems are forecast to grow at a CAGR of 20–25% from 2025 to 2030. The security and defense sector will remain the largest consumer, accounting for over 40% of total shipments by 2030, as per Fortune Business Insights. Meanwhile, the industrial inspection segment is expected to witness the fastest volume growth, fueled by the need for precise quality control in electronics and aerospace manufacturing.

- Regional Analysis: Asia-Pacific is anticipated to register the highest CAGR, driven by rapid industrialization and government initiatives supporting advanced imaging research, particularly in China, Japan, and South Korea.

- Technology Trends: The transition from time-domain to frequency-domain terahertz systems, and the integration of AI-driven image analysis, are expected to further accelerate market growth and adoption rates.

Overall, the 2025–2030 period will mark a pivotal phase for high-GHz terahertz imaging systems, with significant gains in both revenue and volume, underpinned by technological innovation and expanding application horizons.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for high-GHz terahertz imaging systems is experiencing robust growth, with regional dynamics shaped by technological innovation, regulatory environments, and sector-specific demand. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for market participants.

North America remains a leading region, driven by strong investments in security screening, medical diagnostics, and non-destructive testing. The United States, in particular, benefits from significant R&D funding and the presence of key industry players such as TeraView and Advantest Corporation. The region’s regulatory support for advanced imaging in healthcare and homeland security further accelerates adoption. According to MarketsandMarkets, North America accounted for over 35% of the global market share in 2024, a trend expected to continue into 2025.

Europe is characterized by a strong focus on industrial quality control and scientific research. Countries like Germany, the UK, and France are investing in terahertz imaging for pharmaceutical inspection and automotive manufacturing. The European Union’s emphasis on innovation and safety standards, supported by funding from programs such as Horizon Europe, is fostering market growth. Companies like TOPTICA Photonics AG are at the forefront of product development. The region is projected to see a CAGR of 18% through 2025, according to IDTechEx.

- Asia-Pacific is the fastest-growing market, propelled by rapid industrialization, expanding electronics manufacturing, and increasing healthcare expenditure. China, Japan, and South Korea are leading adopters, with government initiatives supporting advanced imaging technologies. The presence of major electronics manufacturers and a burgeoning semiconductor industry are key growth drivers. Fortune Business Insights reports that Asia-Pacific’s market share is expected to surpass 30% by 2025.

- Rest of the World (RoW) includes Latin America, the Middle East, and Africa, where adoption is slower but rising. Growth is primarily seen in security and border control applications, with gradual expansion into medical and industrial sectors as infrastructure improves.

Overall, regional market dynamics for high-GHz terahertz imaging systems in 2025 reflect a blend of technological leadership, regulatory frameworks, and sector-specific demand, with Asia-Pacific emerging as a key growth engine alongside established markets in North America and Europe.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for high-GHz terahertz (THz) imaging systems in 2025 is marked by rapid technological advancements and expanding application domains, driving both innovation and investment. As the frequency range of THz imaging systems pushes further into the high-GHz spectrum (typically 100 GHz to several THz), new capabilities are emerging that address longstanding challenges in resolution, penetration depth, and material discrimination.

Emerging applications are particularly prominent in sectors such as security screening, non-destructive testing (NDT), medical diagnostics, and advanced manufacturing. In security, high-GHz THz imaging systems are being adopted for their ability to detect concealed threats with greater accuracy and speed, outperforming traditional X-ray and millimeter-wave scanners. Airports and border control agencies are piloting next-generation scanners that leverage the unique spectral signatures of explosives and narcotics, a trend highlighted in recent deployments by Smiths Detection and Rapiscan Systems.

In the medical field, high-GHz THz imaging is gaining traction for its non-ionizing, high-resolution imaging capabilities, particularly in dermatology and oncology. Research institutions and startups are developing portable THz imaging devices for early cancer detection and real-time surgical guidance, as reported by Nature Scientific Reports. The ability to differentiate between healthy and malignant tissues at the cellular level is expected to drive significant investment in clinical trials and commercialization efforts through 2025.

Industrial applications are also expanding, with high-GHz THz systems being integrated into quality control processes for advanced materials, semiconductors, and aerospace components. Companies such as TOPTICA Photonics and Advantest Corporation are leading the way in developing robust, high-throughput THz imaging solutions for inline inspection and defect analysis.

From an investment perspective, venture capital and corporate R&D funding are increasingly targeting startups and scale-ups focused on miniaturization, cost reduction, and AI-driven image analysis for THz systems. According to IDTechEx, the global THz technology market is projected to surpass $1.5 billion by 2025, with high-GHz imaging systems representing a significant share of this growth. Investment hotspots include North America, Europe, and East Asia, where government-backed initiatives and public-private partnerships are accelerating commercialization and adoption.

Challenges, Risks, and Strategic Opportunities

The market for high-GHz terahertz (THz) imaging systems in 2025 is characterized by a complex interplay of challenges, risks, and strategic opportunities. As these systems push the boundaries of frequency and resolution, several technical and commercial hurdles must be addressed to unlock their full potential.

Challenges and Risks

- Technical Complexity: High-GHz THz imaging systems require advanced materials, precise fabrication, and sophisticated signal processing. The integration of components such as sources, detectors, and optics at these frequencies remains a significant engineering challenge, often resulting in high costs and limited scalability (Optica).

- Cost and Commercialization: The high cost of system development and deployment limits adoption, especially in price-sensitive sectors. Manufacturing yields for key components, such as quantum cascade lasers and Schottky diode detectors, remain low, impacting overall system affordability (IDTechEx).

- Regulatory and Safety Concerns: As THz systems operate at frequencies bordering the infrared and microwave spectrum, regulatory frameworks are still evolving. Concerns about biological effects and electromagnetic interference may slow market penetration, particularly in medical and security applications (Federal Communications Commission).

- Market Fragmentation: The market is fragmented across diverse applications—ranging from non-destructive testing and quality control to security screening and biomedical imaging. This fragmentation complicates the development of standardized solutions and hinders economies of scale (MarketsandMarkets).

Strategic Opportunities

- Emerging Applications: Advances in high-GHz THz imaging are opening new opportunities in semiconductor inspection, pharmaceutical quality assurance, and advanced material characterization. These high-value niches can justify premium pricing and drive early adoption (Gartner).

- Integration with AI and Data Analytics: Leveraging artificial intelligence for image reconstruction and defect detection can enhance system performance and broaden use cases, particularly in automated industrial environments (IBM).

- Collaborative R&D and Standardization: Strategic partnerships between academia, industry, and government agencies can accelerate innovation, reduce costs, and foster the development of interoperable standards, facilitating broader market adoption (National Institute of Standards and Technology).

In summary, while high-GHz terahertz imaging systems face significant technical and market risks in 2025, targeted innovation and strategic collaboration present clear pathways to overcoming these barriers and capturing emerging opportunities.

Sources & References

- MarketsandMarkets

- TeraSense Group

- TOPTICA Photonics

- Grand View Research

- IDTechEx

- Optica

- IEEE

- Menlo Systems GmbH

- Advantest Corporation

- Canon Inc.

- Fortune Business Insights

- TeraView

- Smiths Detection

- Rapiscan Systems

- Nature Scientific Reports

- IBM

- National Institute of Standards and Technology