Regenerative Medicine Bioprinting in 2025: How Next-Gen 3D Printing is Transforming Tissue Engineering and Shaping the Future of Healthcare. Explore the Market Forces, Innovations, and Growth Trajectory Powering This Revolutionary Sector.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size and Forecast (2025–2030): Growth Projections and CAGR Analysis

- Technological Innovations: Advances in Bioprinting Hardware and Bioinks

- Leading Companies and Strategic Partnerships (e.g., organovo.com, cellink.com, regenhu.com)

- Clinical Applications: Tissue, Organ, and Scaffold Bioprinting

- Regulatory Landscape and Industry Standards (e.g., fda.gov, isctglobal.org)

- Investment, Funding, and M&A Activity in Bioprinting

- Challenges: Scalability, Vascularization, and Ethical Considerations

- Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

- Future Outlook: Disruptive Potential and Long-Term Impact on Regenerative Medicine

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

Regenerative medicine bioprinting is poised for significant advancements in 2025, driven by rapid technological innovation, increased investment, and expanding clinical applications. The sector is witnessing a convergence of 3D bioprinting technologies with stem cell science, enabling the fabrication of complex, functional tissues and organoids. This progress is underpinned by the growing demand for personalized medicine, organ transplantation alternatives, and more predictive drug testing models.

Key industry players are accelerating the translation of bioprinted constructs from laboratory research to clinical and commercial settings. Organovo Holdings, Inc., a pioneer in 3D bioprinting, continues to develop human tissue models for drug discovery and disease modeling, with a focus on liver and kidney tissues. Meanwhile, CELLINK (a BICO company) is expanding its portfolio of bioprinters and bioinks, supporting both academic and industrial partners in tissue engineering and regenerative medicine. 3D Systems is also advancing its bioprinting division, collaborating with research institutions to develop vascularized tissue constructs and exploring applications in orthopedics and reconstructive surgery.

In 2025, the regulatory landscape is evolving to accommodate the unique challenges of bioprinted products. Regulatory agencies in the US, EU, and Asia are engaging with industry stakeholders to establish frameworks for the approval and commercialization of bioprinted tissues and organs. This is expected to streamline the pathway for clinical trials and eventual market entry, particularly for products addressing unmet medical needs such as organ shortages and chronic tissue injuries.

Investment in regenerative medicine bioprinting is robust, with both public and private funding supporting R&D and infrastructure expansion. Strategic partnerships between bioprinting companies, pharmaceutical firms, and healthcare providers are accelerating the development of clinically relevant products. For example, Organovo Holdings, Inc. and CELLINK have announced collaborations with leading academic medical centers to advance preclinical and translational research.

Looking ahead, the next few years are expected to bring further breakthroughs in the bioprinting of vascularized tissues, skin, cartilage, and potentially more complex organs. The integration of artificial intelligence and automation into bioprinting workflows will enhance reproducibility and scalability. As the field matures, regenerative medicine bioprinting is set to play a transformative role in personalized healthcare, drug development, and ultimately, the realization of functional organ replacement.

Market Size and Forecast (2025–2030): Growth Projections and CAGR Analysis

The regenerative medicine bioprinting market is poised for robust expansion between 2025 and 2030, driven by accelerating technological advancements, increased investment, and a growing pipeline of clinical applications. As of 2025, the global market is estimated to be valued in the low single-digit billions (USD), with projections indicating a compound annual growth rate (CAGR) ranging from 15% to 25% over the next five years. This growth is underpinned by the convergence of 3D bioprinting technologies, stem cell research, and the rising demand for personalized medicine.

Key industry players are actively scaling up their bioprinting capabilities and expanding their commercial reach. Organovo Holdings, Inc., a pioneer in 3D bioprinted human tissues, continues to develop functional tissue models for drug discovery and disease modeling, with an eye toward future therapeutic applications. CELLINK (a BICO company), recognized for its broad portfolio of bioprinters and bioinks, is collaborating with academic and pharmaceutical partners to accelerate the translation of bioprinted tissues into clinical and research settings. 3D Systems has expanded its regenerative medicine division, focusing on the development of bioprinted solid organs and complex tissue constructs, leveraging its expertise in additive manufacturing.

The market’s growth trajectory is further supported by strategic partnerships and investments. For example, 3D Bioprinting Solutions is advancing its work on bioprinted organ constructs, including liver and kidney tissues, and has engaged in collaborations with international research institutions. Meanwhile, Allevi (now part of 3D Systems) continues to supply bioprinters and bioinks to research labs worldwide, facilitating the development of vascularized tissues and organoids.

Geographically, North America and Europe are expected to maintain market leadership due to strong R&D infrastructure, supportive regulatory environments, and significant funding. However, Asia-Pacific is anticipated to witness the fastest growth, propelled by increasing investments in biotechnology and regenerative medicine, particularly in China, Japan, and South Korea.

Looking ahead to 2030, the market is expected to be shaped by the commercialization of bioprinted tissues for transplantation, the expansion of bioprinted models for drug testing, and the integration of artificial intelligence for design optimization. The entry of new players and the scaling of manufacturing capabilities will likely intensify competition and drive innovation, positioning regenerative medicine bioprinting as a transformative force in healthcare and life sciences.

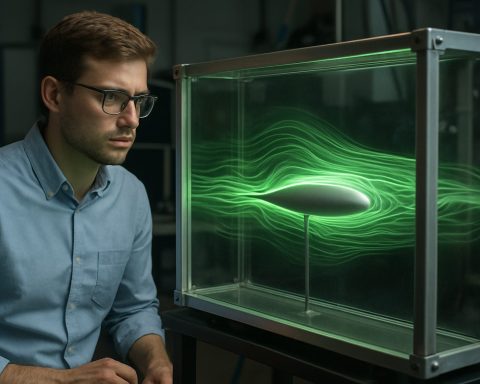

Technological Innovations: Advances in Bioprinting Hardware and Bioinks

The field of regenerative medicine bioprinting is experiencing rapid technological innovation, particularly in the development of advanced bioprinting hardware and bioinks. As of 2025, several key players are driving progress by introducing next-generation 3D bioprinters and novel bioink formulations, aiming to address the challenges of tissue complexity, scalability, and cell viability.

Bioprinting hardware has evolved significantly, with companies such as CELLINK (a BICO company) and RegenHU leading the market in modular, multi-material bioprinters. CELLINK’s latest systems, including the BIO X6, offer six printheads and compatibility with a wide range of bioinks, enabling the fabrication of complex, multi-cellular tissue constructs. RegenHU’s 3DDiscovery Evolution platform integrates multiple dispensing technologies, supporting the precise deposition of cells, hydrogels, and growth factors. These advancements are crucial for replicating the intricate microenvironments found in native tissues.

Another notable innovator, Organovo, continues to refine its proprietary bioprinting platforms for the creation of functional human tissues, focusing on liver and kidney models for both therapeutic and drug testing applications. Meanwhile, Allevi (now part of 3D Systems) has expanded its bioprinter portfolio, emphasizing user-friendly interfaces and open-source compatibility to accelerate research adoption.

On the bioink front, the industry is witnessing a surge in the development of tunable, tissue-specific formulations. CELLINK has introduced a suite of standardized and custom bioinks, including GelMA and collagen-based variants, optimized for cell viability and print fidelity. RegenHU collaborates with academic and industrial partners to develop bioinks tailored for bone, cartilage, and neural tissue engineering. These bioinks are increasingly incorporating bioactive molecules and extracellular matrix components to better mimic physiological conditions.

Looking ahead, the next few years are expected to bring further integration of real-time monitoring and automation in bioprinting systems, enhancing reproducibility and throughput. Companies are also investing in closed-loop feedback systems and AI-driven print optimization, aiming to reduce variability and improve the scalability of tissue manufacturing. The convergence of advanced hardware, smart bioinks, and digital workflow solutions positions regenerative medicine bioprinting for significant breakthroughs in personalized tissue therapies and organ-on-chip models by the late 2020s.

Leading Companies and Strategic Partnerships (e.g., organovo.com, cellink.com, regenhu.com)

The regenerative medicine bioprinting sector in 2025 is characterized by rapid technological advancements and a dynamic landscape of leading companies and strategic partnerships. Key players are leveraging collaborations to accelerate the translation of bioprinting innovations from research to clinical and commercial applications.

One of the pioneering companies in this field is Organovo, which has been at the forefront of developing functional human tissues using proprietary 3D bioprinting technology. Organovo’s focus on creating liver and kidney tissue models for drug discovery and disease modeling has led to partnerships with major pharmaceutical firms and research institutions. In 2024, Organovo announced new collaborations aimed at advancing the development of implantable therapeutic tissues, signaling a shift toward clinical applications expected to mature in the coming years.

Another major player, CELLINK (a part of BICO Group), continues to expand its global footprint in 2025. CELLINK offers a comprehensive portfolio of bioprinters, bioinks, and software solutions, serving both academic and industrial clients. The company’s strategic acquisitions and partnerships, such as with tissue engineering firms and life science tool providers, have strengthened its position as a leading supplier of integrated bioprinting platforms. CELLINK’s collaborations with pharmaceutical companies are expected to drive further adoption of bioprinted tissue models for drug screening and personalized medicine.

Swiss-based RegenHU is recognized for its advanced multi-material bioprinting systems, which enable the fabrication of complex tissue constructs. RegenHU’s partnerships with universities and biotech companies focus on developing next-generation biofabrication protocols and materials. In 2025, the company is actively involved in European consortia aimed at standardizing bioprinting processes and accelerating regulatory pathways for clinical translation.

Other notable companies include Allevi (now part of 3D Systems), which provides accessible desktop bioprinters and has established collaborations with research institutions to develop vascularized tissue models. Aspect Biosystems is advancing microfluidic bioprinting technologies and has entered into partnerships with pharmaceutical and regenerative medicine companies to co-develop therapeutic tissue constructs.

Looking ahead, the next few years are expected to see increased consolidation and cross-sector partnerships, as companies seek to integrate bioprinting with cell therapy, biomaterials, and digital health platforms. Strategic alliances between bioprinting firms, pharmaceutical companies, and regulatory bodies will be crucial for scaling up manufacturing, ensuring quality control, and navigating the complex regulatory landscape. As these collaborations mature, the sector is poised for significant breakthroughs in the commercialization of bioprinted tissues and organs, with the potential to transform regenerative medicine by 2030.

Clinical Applications: Tissue, Organ, and Scaffold Bioprinting

Regenerative medicine bioprinting is rapidly advancing toward clinical translation, with 2025 poised to be a pivotal year for tissue, organ, and scaffold bioprinting applications. The field is moving beyond proof-of-concept studies, with several companies and research institutions reporting significant progress in the fabrication of functional tissues and scaffolds for therapeutic use.

One of the most prominent areas of clinical application is the bioprinting of skin, cartilage, and bone tissues. Companies such as Organovo have been at the forefront, developing 3D bioprinted human tissues for drug testing and disease modeling, and are now progressing toward clinical-grade tissue implants. In 2025, the focus is on scaling up production and ensuring regulatory compliance for human therapeutic use. Similarly, CELLINK (a BICO company) is actively collaborating with academic and clinical partners to develop bioprinted skin grafts and cartilage constructs, with several preclinical studies underway and early-stage clinical trials anticipated in the next few years.

Scaffold bioprinting is also seeing rapid adoption, particularly for bone regeneration. 3D Systems has developed bioprinting platforms capable of producing patient-specific bone scaffolds, which are being evaluated for use in maxillofacial and orthopedic surgeries. These scaffolds are designed to promote vascularization and integration with native tissue, addressing key challenges in regenerative medicine.

Organ bioprinting remains a longer-term goal, but 2025 is expected to see continued progress in the fabrication of miniaturized organoids and functional tissue patches. Aspect Biosystems is developing bioprinted liver and pancreatic tissue constructs for transplantation and disease modeling, with a focus on achieving vascularization and functional integration. The company’s microfluidic bioprinting technology enables the creation of complex, multicellular structures, which are critical for organ-level function.

Looking ahead, the next few years will likely bring the first clinical trials of bioprinted tissues for skin, cartilage, and bone repair, as well as expanded use of bioprinted scaffolds in reconstructive surgery. Regulatory agencies are working closely with industry leaders to establish standards for safety, efficacy, and manufacturing quality. As bioprinting technologies mature, the outlook for regenerative medicine is increasingly optimistic, with the potential to address unmet clinical needs and reduce reliance on donor tissues.

Regulatory Landscape and Industry Standards (e.g., fda.gov, isctglobal.org)

The regulatory landscape for regenerative medicine bioprinting is rapidly evolving as the technology matures and moves closer to clinical application. In 2025, regulatory agencies and industry bodies are intensifying efforts to establish clear frameworks and standards to ensure the safety, efficacy, and quality of bioprinted tissues and organs.

In the United States, the U.S. Food and Drug Administration (FDA) continues to play a pivotal role. The FDA’s Center for Biologics Evaluation and Research (CBER) oversees the regulation of human cells, tissues, and cellular and tissue-based products (HCT/Ps), which includes many bioprinted constructs. The agency has issued guidance documents on regenerative medicine advanced therapies (RMATs) and is actively engaging with industry stakeholders to address the unique challenges posed by bioprinting, such as variability in bioinks, cell sourcing, and manufacturing reproducibility. In 2024 and 2025, the FDA has increased its focus on premarket pathways for bioprinted products, including Investigational New Drug (IND) applications and Biologics License Applications (BLA), and is expected to release further clarifications on requirements for clinical trials and post-market surveillance.

Globally, the European Medicines Agency (EMA) and other regulatory bodies are also updating their frameworks to accommodate bioprinted products, often classifying them as Advanced Therapy Medicinal Products (ATMPs). The EMA is collaborating with international partners to harmonize standards and facilitate cross-border clinical research and product approvals.

Industry organizations such as the International Society for Cell & Gene Therapy (ISCT) and the ASTM International are instrumental in developing consensus standards for bioprinting processes, quality control, and characterization of bioprinted tissues. In 2025, ASTM is expected to expand its suite of standards for additive manufacturing in the biomedical sector, addressing issues such as sterility, mechanical integrity, and cell viability in bioprinted constructs.

Leading bioprinting companies, including Organovo Holdings, Inc. and CELLINK (a BICO company), are actively participating in regulatory discussions and pilot programs. These companies are working closely with regulators to validate their manufacturing processes and demonstrate compliance with emerging standards, aiming to accelerate the path to clinical translation.

Looking ahead, the next few years will likely see the introduction of more formalized regulatory pathways and internationally recognized standards for regenerative medicine bioprinting. This will be crucial for fostering innovation, ensuring patient safety, and enabling the commercialization of bioprinted tissues and organs on a global scale.

Investment, Funding, and M&A Activity in Bioprinting

The regenerative medicine bioprinting sector is experiencing a dynamic phase of investment, funding, and merger and acquisition (M&A) activity as of 2025, reflecting both the maturation of core technologies and the growing confidence of institutional investors. The field, which focuses on fabricating living tissues and organs using advanced 3D bioprinting, is attracting capital from venture funds, strategic corporate investors, and public markets, with a particular emphasis on companies demonstrating translational progress toward clinical applications.

In recent years, several high-profile funding rounds have underscored the sector’s momentum. Organovo Holdings, Inc., a pioneer in 3D bioprinted human tissues, has continued to secure capital to expand its portfolio of bioprinted liver and kidney tissues, targeting both drug discovery and regenerative medicine markets. Similarly, CELLINK (a part of BICO Group), recognized for its bioprinting platforms and bioinks, has attracted significant investment to scale its global operations and accelerate the development of new tissue engineering solutions. The company’s acquisition strategy, including the integration of complementary firms in the biofabrication space, has further consolidated its position as a market leader.

Strategic partnerships and M&A activity are also shaping the landscape. 3D Systems Corporation, a major player in additive manufacturing, has expanded its regenerative medicine division through targeted acquisitions and collaborations, notably with research institutions and clinical partners. The company’s focus on bioprinting for organ and tissue regeneration has been bolstered by investments in proprietary printing technologies and bioinks. Meanwhile, Stratasys Ltd. has signaled increased interest in the bioprinting sector, leveraging its expertise in 3D printing hardware to explore applications in tissue engineering and regenerative medicine.

Government and institutional funding remain critical drivers, with agencies in the US, Europe, and Asia supporting translational research and commercialization efforts. For example, the US-based Advanced Regenerative Manufacturing Institute (ARMI) continues to channel public-private investments into bioprinting infrastructure and workforce development, aiming to accelerate the path from laboratory innovation to clinical-grade manufacturing.

Looking ahead to the next few years, the outlook for investment and M&A in regenerative medicine bioprinting is robust. As clinical trials for bioprinted tissues advance and regulatory pathways become clearer, the sector is expected to see further capital inflows, strategic consolidations, and cross-sector collaborations. This trend is likely to be reinforced by the growing demand for personalized medicine and the urgent need for transplantable tissues, positioning bioprinting as a focal point for both financial and strategic investment in the life sciences.

Challenges: Scalability, Vascularization, and Ethical Considerations

Regenerative medicine bioprinting stands at the forefront of biomedical innovation, yet its translation from laboratory breakthroughs to widespread clinical application faces significant challenges. As of 2025, three primary hurdles—scalability, vascularization, and ethical considerations—continue to shape the trajectory of this field.

Scalability remains a central obstacle. While bioprinting has demonstrated the ability to fabricate small, functional tissue constructs, scaling these up to clinically relevant sizes is complex. The production of large, viable tissues or whole organs requires not only advanced bioprinters but also consistent, high-quality bioinks and robust post-printing maturation processes. Companies such as Organovo Holdings, Inc. and CELLINK (now part of BICO Group) are actively developing scalable bioprinting platforms and standardized bioinks, yet the leap from millimeter-scale tissues to full organ systems is still in progress. The need for reproducibility and regulatory compliance further complicates mass production, as each printed construct must meet stringent safety and efficacy standards.

Vascularization—the creation of functional blood vessel networks within bioprinted tissues—is another critical challenge. Without adequate vascularization, larger tissue constructs cannot receive sufficient oxygen and nutrients, leading to cell death and tissue necrosis. Recent advances include the use of sacrificial bioinks and coaxial printing techniques to form perfusable channels, as explored by Aspect Biosystems and Prellis Biologics. However, integrating these microvascular networks with the host’s circulatory system post-implantation remains a major scientific and engineering hurdle. Ongoing research in 2025 is focused on improving the fidelity and functionality of these networks, with the aim of supporting the survival and integration of larger, more complex tissues.

Ethical considerations are increasingly prominent as bioprinting technologies approach clinical reality. Issues include the sourcing of human cells, the potential for creating human-animal chimeras, and questions of access and equity. Regulatory bodies and industry leaders, such as 3D Systems (which acquired bioprinting innovator Allevi), are engaging with bioethicists and policymakers to establish guidelines for responsible development and deployment. Transparency in clinical trials, informed consent, and equitable access to bioprinted therapies are expected to be focal points in the coming years.

Looking ahead, overcoming these challenges will require coordinated efforts across industry, academia, and regulatory agencies. Advances in automation, materials science, and vascular engineering are anticipated to drive progress, while ethical frameworks will be essential to ensure that regenerative medicine bioprinting fulfills its promise in a responsible and inclusive manner.

Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

The global landscape for regenerative medicine bioprinting is rapidly evolving, with North America, Europe, Asia-Pacific, and emerging markets each demonstrating distinct trajectories in 2025 and the coming years. These regions are shaped by differences in research infrastructure, regulatory environments, investment levels, and the presence of pioneering companies.

North America remains at the forefront of regenerative medicine bioprinting, driven by robust R&D ecosystems and significant funding. The United States, in particular, is home to leading bioprinting innovators such as Organovo Holdings, Inc., which continues to advance 3D bioprinted human tissues for drug discovery and disease modeling. Another key player, CELLINK (now part of BICO Group), maintains a strong presence in the U.S. market, supplying bioprinters and bioinks to academic and commercial labs. The region benefits from collaborations between universities, hospitals, and industry, as well as supportive regulatory pathways from agencies like the FDA, which are increasingly engaging with bioprinted tissue applications.

Europe is characterized by a collaborative research environment and strong public funding, particularly in countries such as Germany, the United Kingdom, and Sweden. Companies like CELLINK (headquartered in Sweden) and RegenHU (Switzerland) are prominent, offering advanced bioprinting platforms and materials. The European Union’s Horizon Europe program continues to fund cross-border regenerative medicine projects, fostering innovation and standardization. Regulatory harmonization efforts are underway, aiming to streamline the approval of bioprinted products for clinical use, which is expected to accelerate market entry in the next few years.

Asia-Pacific is witnessing rapid growth, fueled by increasing investments in biotechnology and government initiatives. China and Japan are leading the region, with institutions and companies such as Invivo Biotechnology (China) and Cyfuse Biomedical (Japan) developing proprietary bioprinting technologies. The region’s large patient populations and rising demand for organ and tissue regeneration are driving adoption. Strategic partnerships between local firms and global technology providers are expected to further boost capabilities and market penetration through 2025 and beyond.

Emerging markets in Latin America, the Middle East, and Africa are at earlier stages of adoption but are showing increasing interest, particularly in academic and research settings. While infrastructure and funding remain challenges, international collaborations and technology transfer initiatives are beginning to bridge gaps. As costs decrease and awareness grows, these regions are anticipated to play a more significant role in the global bioprinting ecosystem in the latter half of the decade.

Overall, the next few years will see continued regional diversification, with North America and Europe leading in innovation and clinical translation, Asia-Pacific rapidly expanding its capabilities, and emerging markets gradually integrating bioprinting technologies into their healthcare and research systems.

Future Outlook: Disruptive Potential and Long-Term Impact on Regenerative Medicine

Regenerative medicine bioprinting is poised to become a transformative force in healthcare, with 2025 marking a pivotal year for both technological maturation and clinical translation. The field, which leverages 3D bioprinting to fabricate living tissues and potentially whole organs, is rapidly advancing from proof-of-concept studies to early-stage clinical applications. Several leading companies and research institutions are driving this progress, aiming to address the global shortage of transplantable organs and revolutionize personalized medicine.

In 2025, the focus is shifting from simple tissue constructs to more complex, vascularized structures. Companies such as Organovo Holdings, Inc. have demonstrated the ability to print functional human liver tissue, which is now being explored for use in drug toxicity testing and disease modeling. Meanwhile, CELLINK, a subsidiary of BICO Group, continues to expand its portfolio of bioprinters and bioinks, supporting research into skin, cartilage, and even neural tissue regeneration. Their collaborations with academic and clinical partners are accelerating the translation of laboratory breakthroughs into preclinical and early clinical studies.

A major milestone anticipated in the next few years is the initiation of first-in-human trials for bioprinted tissues. For example, 3D Bioprinting Solutions has reported progress in printing thyroid and pancreatic constructs, with preclinical studies underway. The company is also exploring the use of bioprinted tissues in space, in partnership with international space agencies, to study tissue development in microgravity—an endeavor that could yield insights for both terrestrial and extraterrestrial medicine.

Regulatory agencies are beginning to establish frameworks for the evaluation and approval of bioprinted products, recognizing their disruptive potential. The U.S. Food and Drug Administration (FDA) has initiated dialogue with industry stakeholders to develop guidelines for the clinical translation of bioprinted tissues, focusing on safety, efficacy, and manufacturing standards. This regulatory clarity is expected to catalyze investment and accelerate the path to market for bioprinted therapeutics.

Looking ahead, the long-term impact of regenerative medicine bioprinting could be profound. The ability to produce patient-specific tissues on demand holds promise for reducing transplant waitlists, minimizing immune rejection, and enabling new therapies for previously untreatable conditions. As bioprinting technologies become more sophisticated and scalable, the next decade may see the emergence of fully functional, transplantable organs—a development that would fundamentally reshape the landscape of regenerative medicine and patient care.

Sources & References

- Organovo Holdings, Inc.

- CELLINK

- 3D Systems

- Allevi

- CELLINK

- Organovo

- Allevi

- Aspect Biosystems

- Aspect Biosystems

- European Medicines Agency

- International Society for Cell & Gene Therapy

- ASTM International

- Stratasys Ltd.

- Advanced Regenerative Manufacturing Institute (ARMI)

- Cyfuse Biomedical